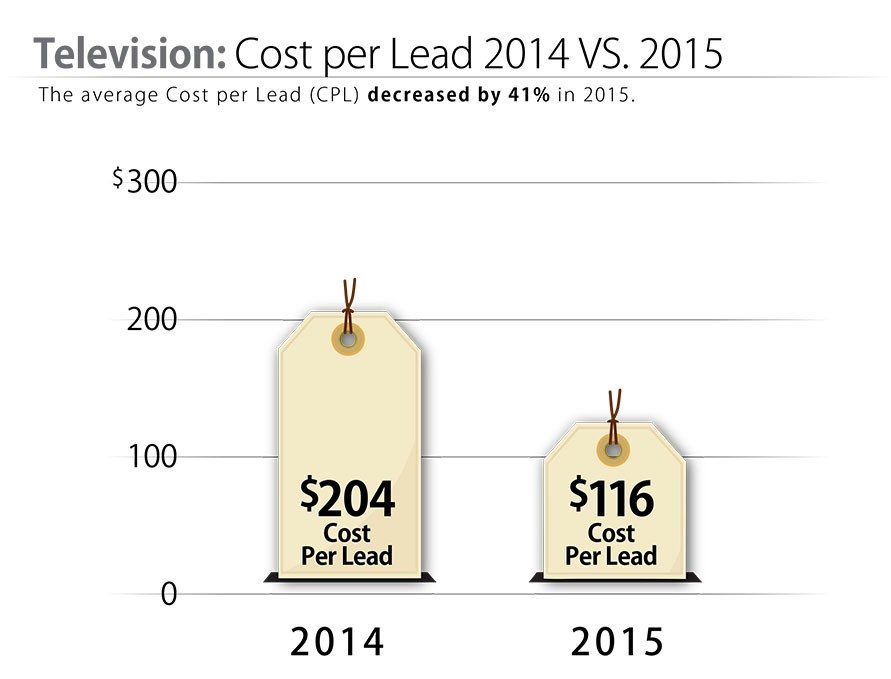

41%

Annual decrease in average cost per lead.

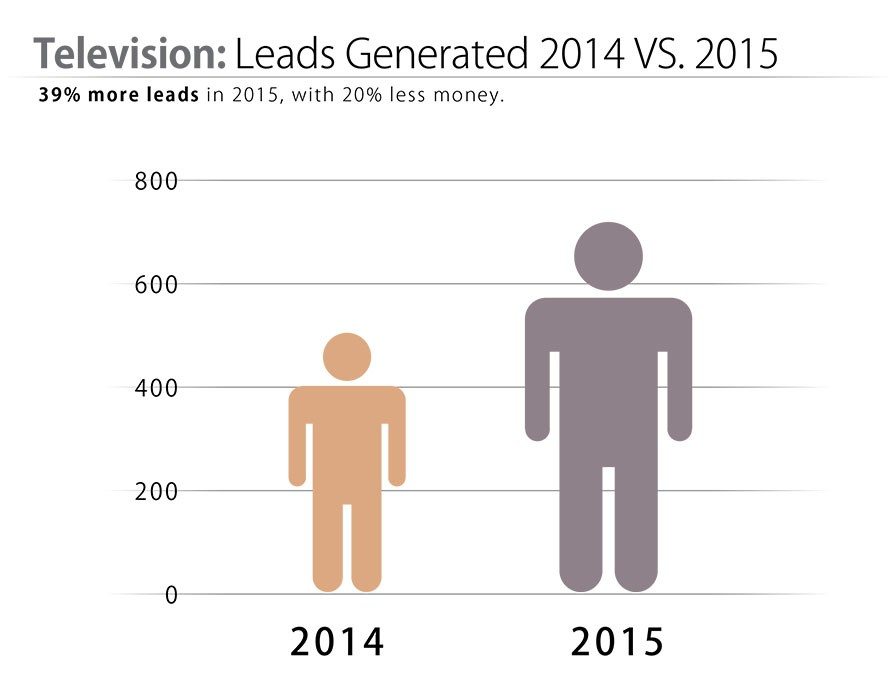

39%

Increase in television leads.

30%

Average cost per lead compared to television lead response.

#1

Search engines consistently put Edwards & Kautz on page one in key online searches (unpaid and organic).

The Challenge: Cut the television advertising budget by 20%, while still generating the same volume of client lead response. Then, redeploy the dollars back into online media for wider reach and more lead production.

The television advertising data analysis for Edwards & Kautz indicated that 20% of the budget was underperforming. The budget needed to be cut and the money redeployed for a lower overall cost per lead (CPL).

The law firm needed a more balanced, multi-media approach: television plus digital advertising. Funding for the advertising strategy shift was to come through cuts in the underperforming media. The challenge was to cut the budget for television in the times and programs that weren’t generating the most leads for the least dollars.

Close scrutiny of the television productivity data showed no bad buys—only programs and times that were better buys. Kirkpatrick Creative demands that every media buy be optimized against the data for maximum lead production from every advertising dollar invested.

Time Period

The comparative study was compiled over 24 months. Consistent monthly advertising was placed and compared over two comparative years.

Projections

Data analytics indicated that approximately 20% of the television advertising budget should be cut, with the cut dollars to shift into digital/online advertising. Data showed that the television media dollars were productive, but could still be more efficient producers when deployed in tandem with digital advertising.

Data tracking made the cuts for television media clear:

- Underperforming stations and programs—those producing marginal prospect leads—were eliminated.

- Higher-performing programming—those producing high-volume prospect leads—were purchased with greater frequency.

Results

Television:

- At the end of year two, the effect of the television leads generated was dramatic: with a 20% cut in the television budget, the law firm prospect leads increased by almost 39%. The resultant decrease in the average cost per lead of 41% was equally dramatic.

Digital:

- Over 1,100 new prospect leads were recorded from this foray into digital advertising. The average cost per lead generated was slightly over $62, as measured by telephone calls and form responses.

- The law firm jumped to page-one preference with search engines for organic rankings.

Combined Multi-Media Deployment:

- An advertising budget increase of only 20% saw a 204% increase in prospect leads for the law firm.

- The total cost per lead decreased by over 43%.