Amazon has made some big changes to its advertising platform—changes that could dramatically affect the advertising strategies of small businesses and large corporations alike.

What’s Different

Introducing Sponsored Brands: the new version of Headline Search Ads, which are “designed to increase reach, efficiency, and performance,” according to Amazon’s announcement of the changes. “Sponsored Brands empower vendors to increase brand consideration and sales on Amazon by promoting multiple products within search results and driving shoppers to a landing page or Store on Amazon.”

Here’s a mockup provided by Amazon:

“In addition to offering a placement above search results, Sponsored Brands will now appear on the left side and bottom of the search results page on desktop, as well as within search results on the Amazon app. This allows more customers to engage as they shop and browse on Amazon,” the post explains.

What it Means

Shoppers could get annoyed at the change

Not many people really enjoy seeing ads online. Particularly to those who aren’t in the mood to be advertised to, they’re irrelevant at best and intrusive at worst.

For desktop shoppers with ad blockers enabled, the Amazon ads update won’t make much of a difference: they won’t see the ads anyway. But for mobile shoppers—where smaller screens mean considerably less visual real estate—poorly-placed ads don’t lend to a great customer experience.

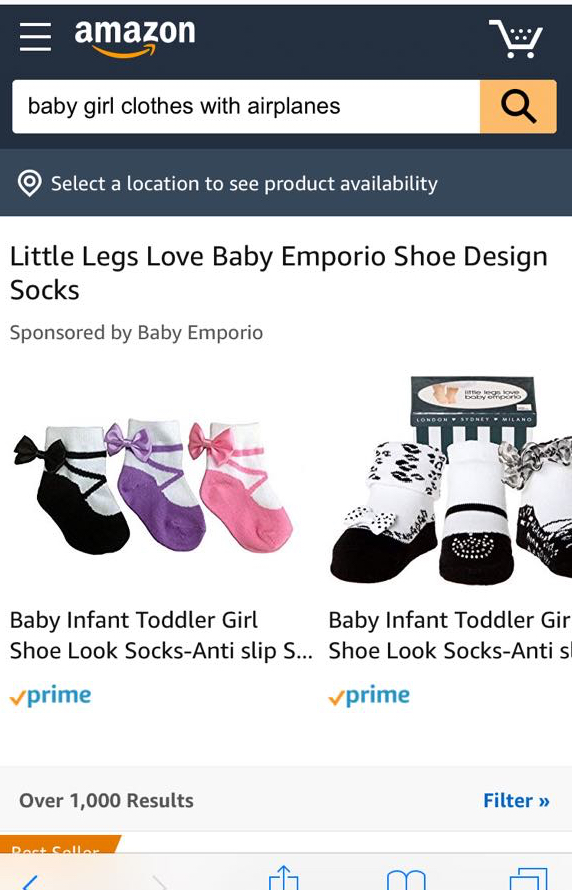

As an example, here’s a screenshot of a search I did recently in the Safari browser on my iPhone:

Do you see any airplanes on those socks? I sure don’t.

Ads like these are pretty annoying when you’re trying to find something specific. In this case, the annoyance is made even worse by the irrelevant search results taking up my entire screen, blocking me from seeing the products I’m actually interested in.

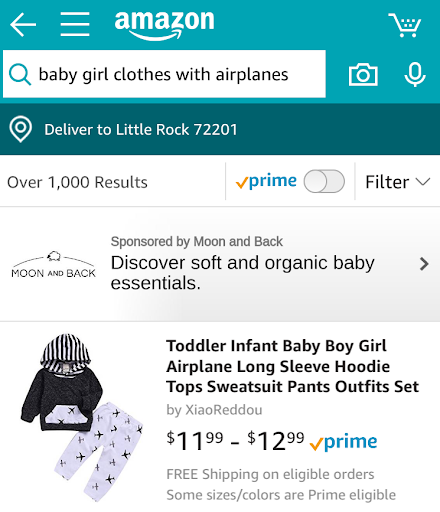

It’s important to note, however, that the same search in the Amazon app gives a relatively non-intrusive text ad, letting me get to the relevant results right away:

Getting the customer to the results she wants is crucial, so creating a better shopping experience in the Amazon app—that is, keeping annoyance to a minimum—is a wise move, especially considering the popularity of the app with shoppers.

In order to avoid losing potential conversions, advertisers will have to figure out which ad placements perform best for their different types of customers and adjust their budgets accordingly.

Bidding for the top-of-search spots could get brutal

No matter the platform, that “top of search” spot on Amazon is about to become one of the most coveted places to advertise on the web.

The new ad placements, however? Not so much.

In its announcement, Amazon wrote that the new ad placements—the ones to the left of and below search results—are intended to “[allow] more customers to engage as they shop and browse on Amazon.” But Search Engine Land reports that while reach does seem to significantly improve with this setup, engagement is nowhere near as high.

“Overall impressions increased 47% after the update; however, clicks did not increase in a meaningful way, which caused the click-through rate to plummet 41%,” writes David Hassler, a senior analyst on the Amazon & eRetail Team at Merkle. “This isn’t surprising, given that each of the new placements occurs below the fold in much less prominent locations…Most users never see these new ad placements, let alone click on them.”

In contrast, the placement of ads above the fold “clearly outperforms other placements across all metrics, which shows just how important it is for advertisers to dominate that space,” says Hassler. “Advertisers must, therefore, be prepared to pay a relatively higher cost-per-click to capitalize on these high-converting clicks.”

High-converting, in this case, translates to 87% more clicks…and 92% more sales. Let the bidding wars begin!

Amazon could pose a threat to Google or Facebook ads

While Facebook and Google remain the top two places for digital advertising, there’s a possibility that Amazon could finally encroach on those spots.

According to a report by Avionos, shoppers on mobile are more likely to use the Amazon app than Google. And when they open the Amazon app to do their shopping, they’re already further down the sales funnel because they have an intent to buy.

“When consumers intend to purchase a product, 38% begin their search with Amazon, while 22% begin with Google,” the report says. “Generally consumers look to Amazon for specific purchases, whereas Google is their source for ideas.”

While this information could seem threatening to Google in terms of advertising spend, it’s doubtful that Amazon shoppers will have anywhere near the volume necessary to make a dent in Google’s estimated share of the digital ad market: 37.2%.

Facebook, on the other hand, is no stranger to controversy concerning its ad platform—and with a 19.6% share of the digital advertising market, they’re a distant second to Google. Because of this, Facebook’s position could very well be threatened by Amazon’s growth.

Will Amazon’s prime advertising real estate—and the habits of the millions of customers it reaches—be enough to bump Facebook down to third place? It’s not incredibly likely, considering the existing strength of the social giant…but stranger things have happened.

Traditional advertising could see a dip

According to the Amazon Advertising Forecast 2019 by Third Door Media, 80% of respondents who currently advertise on Amazon plan to increase their Amazon ad spend in 2019. (20% of those respondents plan to increase them by at least 50%.)

Those increased budgets have to come from somewhere. The report indicates that, while search spend is the most likely budget line to be reduced for the sake of Amazon ads, non-digital advertising is likely to take a hit as well: “Executives see Amazon as the future way to reach shoppers and are shifting spending from traditional advertising channels to cement their place with Amazon.”

This isn’t just a trend on Amazon. A report on global ad spending from eMarketer says that “by 2020, digital’s share of total advertising will near 50%,” and that “digital channels will overtake traditional mediums by 2021.”

With advertisers having to account for the greater ad spend on Amazon, it’s very likely that their traditional budgets will decrease. And considering eMarketer’s predictions, it certainly won’t be surprising to see more advertisers following suit and decreasing their traditional advertising budgets in favor of new digital opportunities.

How to Manage the Changes

The new Amazon ads landscape may be difficult to navigate, but with the right guidance, it can be a powerful tool—for big brands and small businesses alike. If you’re interested in advertising on Amazon, contact Kirkpatrick Creative today and we’ll build an Amazon advertising strategy together.